Not too long ago, I wrote about some surprising reasons that a company can be undervalued. One of them was the owner being too important--the company expert, the oil in the well-oiled machine, the chief problem solver, the one who holds the relationship with the customers.

Here, we explore this through the eyes of the buyer and from the perspective of some experts in the field. Most importantly, we look at one way you can fix it.

Dusty Gulleson is the CEO of eResources, and has a few acquisitions under its belt. Dusty hired me to help eResources buy companies, and with every single target there was a consistent question: "who has the primary relationship with the customers". If the answer was "the owner" then we were usually done. There are lots of problems than can be solved. There are lots of issues you get past, but for Dusty and many others, this one is a non-starter--and for good reason.

We could find a nice, profitable, clean company that is a great strategic fit, has great customers, low customer concentration, is growing, has great employees, great technology and more, but if the customers are there because of the owner personally, then we're not interested. Think of it this way, if the customer "feels like" they are doing business with the owner, then does the business really have any customers at all? That's a strong statement, but when buying a small business, you are often buying the business' ability to produce a certain amount of cash flow in the future. If the owner is gone and all the customers were doing business with the owner, can you really count on that future cash flow?

Here's the challenge to overcome. Most small businesses are successful because of a successful entrepreneur. When you talk to the customers they don't say "I use ABC company down the street" they say "I got a guy who handles that". Their guy might be the CEO of the company that's actually servicing them, but in their mind its "I use Bob, he's great". The problem is, nobody wants to buy Bob.

So, I set out to find a systematic way to tackle this issue. Enter Brand3, Inc. I found myself on a web conference with Matt Christ and Orsi Herbein, the owners of Brand3 who walked me through a methodical way to deal with this issue from their 'legacy branding' process.

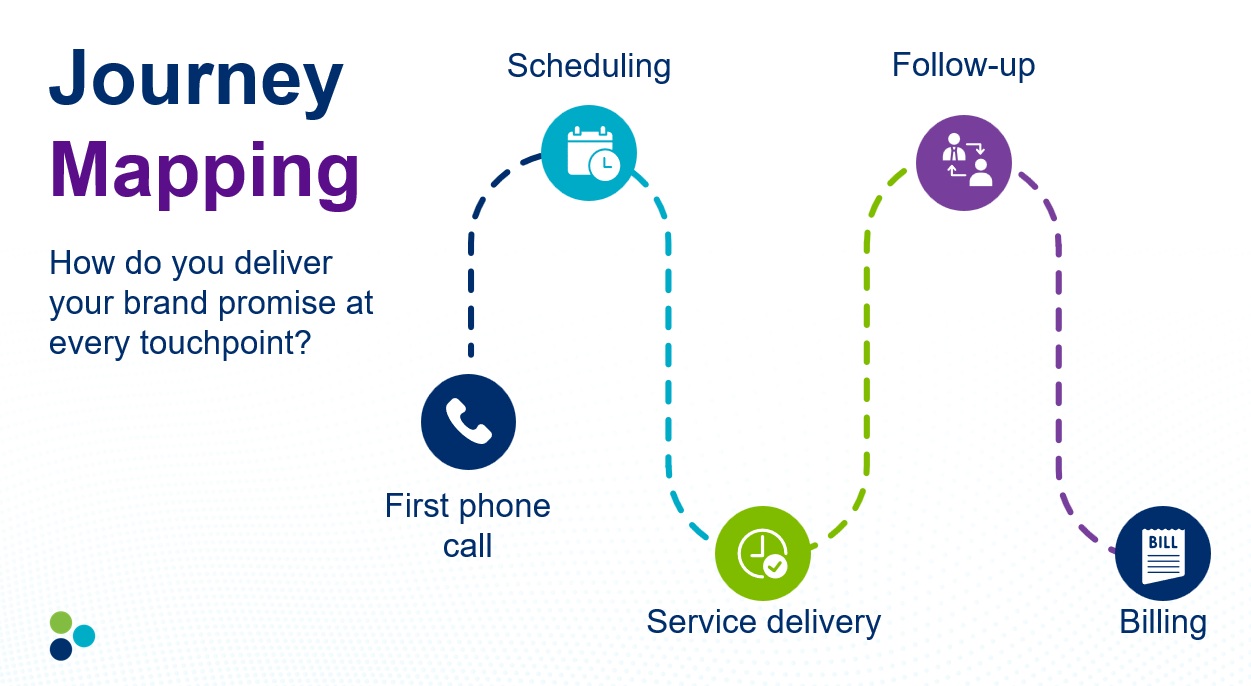

The customer experience has to be realigned to the brand--not the owner. Once this happens, the transition to brand loyalty begins. Simple survey tools like Net Promoter Score (NPS), with some modification, can measure owner dependency issues and provide insight for what needs to be done to realign the customer experience.

Realignment of an internal culture usually requires adjustments in the areas of systems and processes, however building a "brand motivated culture" is the foundation for real change. This can impact the attitude and dedication of a team, thus shifting the identity of the company from the owner to the long-term vision and legacy of the company.

After-all, when we talk about "brand", we are really talking about "identity". Employees that identify and rally around a company and a mission, can be transferred to a new owner. Employees that rally around the owner, aren't very valuable to a new owner.

According to Orsi Herbein, Brand3's Creative Director, "brand is the most powerful intangible asset a company can have." The measurable results of this are loyal customers with potentially higher margins and reduced competition. The business' brand should also be well documented and secure with appropriate trademark registration. This, combined with the business' ability to manage and maintain a consistent image and message, is a critical step to long-term value and sale-ability of the company.

Everything you communicate is either building a consistent brand experience or creating space for your competition to do it better. A small business with a national-quality image is set apart from the mom-and-pop shops, and can be worth more as a result.

Matt Christ, Brand Strategist for Brand3 puts it this way: "A powerful brand experience is the key driver to owning market share. Your brand is either a liability or an asset, there is no middle ground."

This translates to buying and selling companies as well. Is your brand an asset or a liability? If it's the latter, now is the time to get to work and fix it.

The opinions expressed here by Inc.com columnists are their own, not those of Inc.com.

PUBLISHED ON: JUN 21, 2017 Read original article here